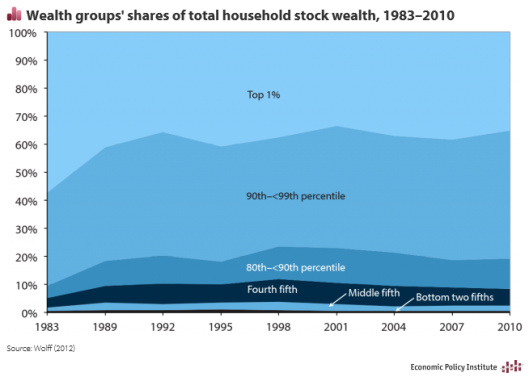

This is the title of a great post on The Washington Post’s “Wonkblog” (see here) that I saw last month (yes, it has taken me, um, a while to put this up on Historicalness.com…good thing I’m not covering breaking news). Their post was made even better since it had a graph:

What we can see is that since the late 1980s, the top 1% wealthiest households have consistently held about 40% of the stock market wealth.

And for those same 25 years, the top 10% have consistently held about 80% of stock market wealth.

As Wonkblog notes, even though “about 52 percent of Americans own at least some stock, mostly in their 401(k)s,” those holdings are tiny compared to the average holdings of the wealthiest households, which are the ones that benefit disproportionately to a stock market increase.

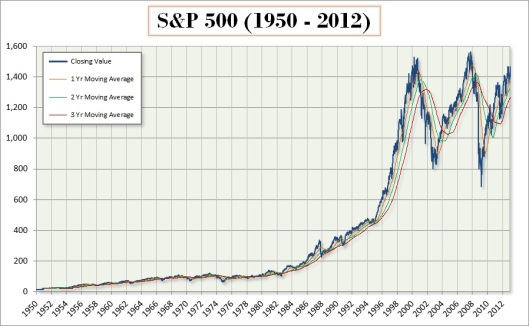

On Friday, the S&P 500 closed at 1,582, just below its all-time high. The stock market has had a dramatic rebound since its late 2008 / early 2009 depths. Here’s a chart showing the S&P’s growth since 1950: